Problems: Land Revenue Trap

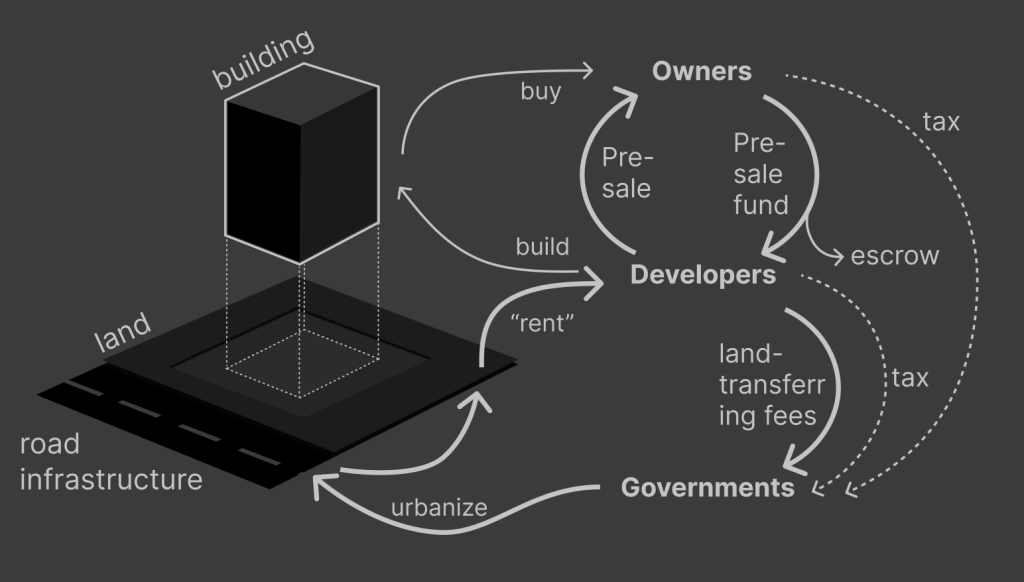

- Land supply – Local governments across China use land sales as the most important source of revenue and artificially keep the property prices high.

- Demand for property – People use real estate as a major investment due to its high returns and absence of taxes.

- Incentives for disproportionate growth – Very large down payments for property led developers to start a lot of buildings without necessarily completing the projects.

- Heavy macroeconomic reliance on housing industry – Real estate market represents 25% of China’s GDP.

Existing policy: Regulation through supervised accounts

- Government incorporated supervised escrow accounts where developers keep 30% of the value of residential projects.

- Proceeds from home sales make up more than 50% of the developers’ cash inflow.

- Policy aimed at preventing project abandonment and misuse of down payment funds.

Results from Policy:

- Liquidity crunch – Due to the high percentage of cash inflow required to be kept in supervised escrow accounts, developers face a liquidity crunch.

- Deceleration of the economy – Because the real estate market supports 25% of the country’s GDP, restrictions on developers cause a property-led slowdown of the economy.

- Need to ease restrictions – The slowdown leads the government to ease restrictions on developers, moving a step back to the previous status quo of unsustainable growth.

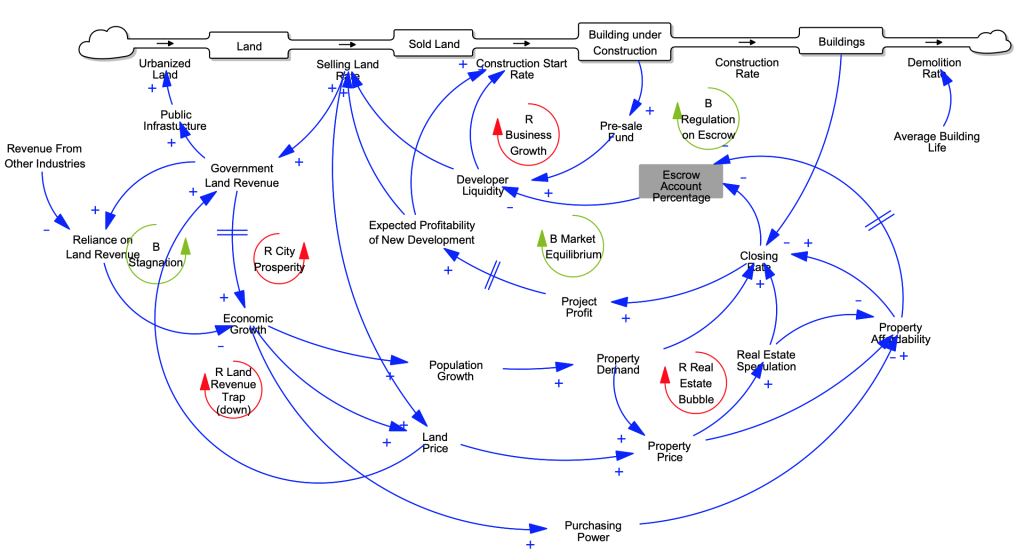

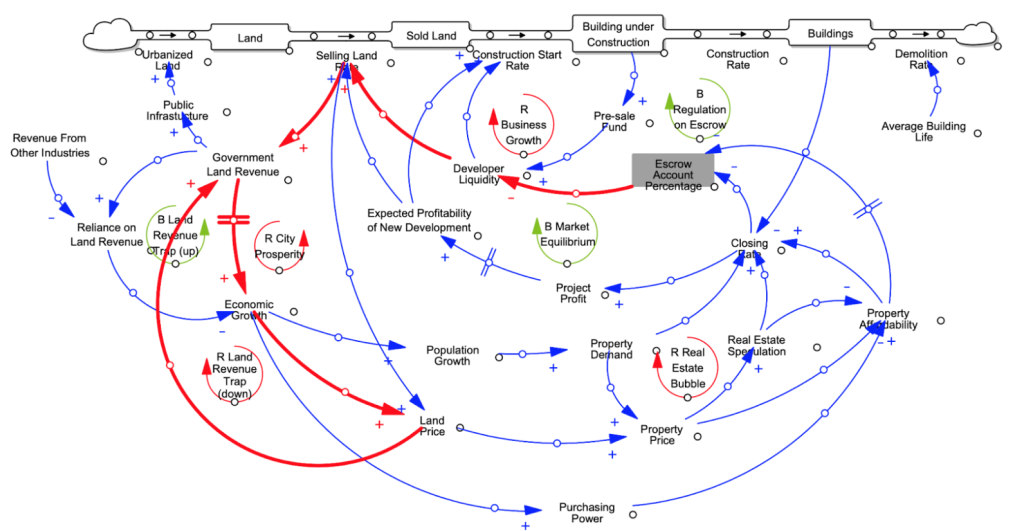

The three main reinforcing loops we identified are Business Growth, City Prosperity and Land Revenue Trap.

The first one refers to the incentives that real estate developers have to keep constructing new buildings without necessarily finishing previous ones through the use of pre-sale funds. The balancing counterpart is the market equilibrium, as there is a limit to the number of buildings needed to house all of the population.

City Prosperity refers to the incentives that governments have to keep expanding urban spaces and taking more land to therefore make more land sales revenue.

Stagnation refers to the fact that there’s a limit to the physical space a government can take to sell land, so the revenue it gets from these sales will eventually stagnate.

In consequence, the Land Revenue Trap is a reinforcing loop that explains that if a government is too reliant on government land revenue and land sales start decreasing, economic growth will decrease and land price will decrease, making it harder for the government to maintain its revenue from land sales.

Let’s look at the escrow account variables. We include the escrow account as an internal variable in this diagram. So when the government observe that the closing rate and affordability decrease which indicates that the property market is probably overheated. The government will launch strict policies on the escrow account to control liquidity of the developers and further to slow down the construction rate.

But at the same time, the lower construction rate leads to lower land selling rate and the government will loses a lot of revenues, which further influences the economic because the city GDP relies on land revenue. Thus, escrow regulation can slow down overheated market in short term. but it can not help the city escape from the land revenue trap.k

So we think, As many experts pointed out, the fundamental solution is to design a tax system to enable the government to capture value from the booming housing market not only at the land acquisition stage but also at the property possession stage.

- Would decrease local governments’ reliance on land sales as main source of revenue

- Would disincentivize excessive use of real estate as a major investment tool.

- it would encourage the developers to switch their business model from “sell fast” to “hold long”.